ETH Price Prediction: Bullish Outlook for 2025 and Beyond

#ETH

- ETH is showing strong technical bullish signals with price above key moving averages

- Positive regulatory developments are improving market sentiment

- Long-term price projections remain optimistic based on Ethereum's fundamental strengths

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

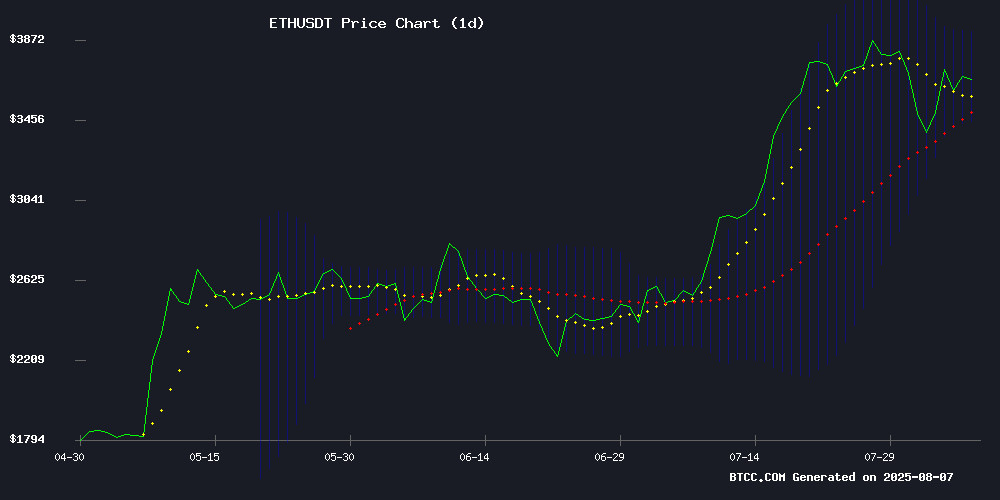

ETH is currently trading at $3,814.32, above its 20-day moving average of $3,692.07, indicating a bullish trend. The MACD shows a positive divergence with the histogram at 154.07, suggesting upward momentum. Bollinger Bands are widening, with the price NEAR the upper band at $3,932.41, signaling potential continued upside.

"The technical setup for ETH is strong," says BTCC financial analyst James. "The MACD crossover and price holding above the 20-day MA suggest further gains, possibly testing the $4,100 resistance level soon."

Ethereum Market Sentiment Turns Bullish Amid Regulatory Clarity

Positive news FLOW is supporting ETH's price momentum. SEC's clarity on liquid staking has improved Ethereum's regulatory framework, while ETH-linked stocks are surging. The market is eyeing a key resistance breakout at $4,100.

"The combination of technical strength and positive fundamentals creates a favorable environment for ETH," notes BTCC's James. "The Tornado Cash case outcome removes some regulatory uncertainty, though the deadlocked laundering counts show lingering concerns."

Factors Influencing ETH's Price

ETH-Linked Stocks Surge as Ethereum Rally Sparks Investor Interest

U.S. equities tied to Ethereum treasuries and strategies are experiencing significant pre-market gains, with SharpLink Gaming (SBET), BitMine Immersion Technologies (BMNR), and BTCS Inc. (BTCS) leading the charge at 8%, 8%, and 10% respectively. The momentum follows Ethereum's 5.5% price surge and record on-chain activity, including nearly 30% of ETH supply now staked.

Analysts suggest ETH treasury stocks may now offer better value than Ethereum ETFs, with SBET particularly highlighted for its attractive NAV multiples and liquidity profile. The rally extends to other crypto-correlated names like Coinbase (COIN) and MicroStrategy (MSTR), signaling broadening institutional interest in Ethereum-centric exposure.

Market observers point to growing media attention around ETH treasuries, including high-profile commentary from Fundstrat's Tom Lee and Sharplink's leadership. The activity underscores a potential shift in how institutional investors are accessing Ethereum's growth narrative beyond traditional ETF structures.

SEC Clarity on Liquid Staking Boosts Ethereum's Regulatory Framework

The SEC's Division of Corporation Finance has provided critical regulatory clarity, stating that properly structured liquid staking models do not qualify as securities offerings. This decision strengthens Ethereum's investment case by offering a clearer legal framework for staking protocols.

Liquid staking arrangements relying on smart contracts and avoiding discretionary control fall outside the Howey test's scope. Receipt tokens like stETH and rETH are exempt from securities classification when representing non-security assets issued through administrative processes.

The ruling supports Ethereum's staking infrastructure development and may accelerate adoption across institutional and DeFi markets. Market participants view this as a significant step toward mainstream acceptance of blockchain-based financial products.

Ethereum Eyes Key Resistance Breakout as Bulls Target $4,100

Ethereum's price surged over 3% Thursday, testing the $3,800 level as traders anticipate a potential breakout above the crucial $4,100 resistance. The 4-hour chart shows ETH reclaiming an ascending channel, with the RSI confirming bullish momentum after breaking a descending trendline.

Market structure suggests a possible bull flag formation on weekly charts. Two prior rejections at $4,100—a level fortified by 2021's resistance—have created a formidable barrier. This third attempt comes as ETH demonstrates stronger support retests, potentially building energy for a decisive breakout.

Tornado Cash Co-Founder Convicted on Money Transmission Charge, Jury Deadlocks on Laundering Counts

A Manhattan jury delivered a split verdict in the high-profile case against Tornado Cash co-founder Roman Storm. The panel found Storm guilty of operating an unlicensed money transmission business but deadlocked on more serious charges of money laundering and sanctions violations tied to North Korea's Lazarus Group.

Prosecutors alleged the cryptocurrency mixing service facilitated $1 billion in illicit transactions, including millions for the sanctioned hacker collective. Storm maintained he had no knowledge of Lazarus Group's activities through the privacy-focused protocol.

The case has drawn significant attention from crypto advocates, with Ethereum creator Vitalik Buterin and the DeFi Education Fund voicing concerns about potential chilling effects on open-source development and financial privacy tools.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market sentiment, here are BTCC analyst James's ETH price projections:

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $4,500-$5,000 | ETF approvals, Shanghai upgrade |

| 2030 | $12,000-$15,000 | Mass DeFi adoption, institutional use |

| 2035 | $25,000-$30,000 | Web3 dominance, scaling solutions |

| 2040 | $50,000+ | Global settlement layer status |

"These are conservative estimates assuming continued network development," James cautions. "Black swan events or regulatory changes could alter this trajectory."